Tuolumne County’s debt is disclosed in the Annual Comprehensive Financial Report (ACFR), previously known as the Comprehensive Annual Financial Report (CAFR).

According to CA Government Code Sections 25250 and 25253, the Annual Comprehensive Financial Report must be published within 180 days of the end of the fiscal year (December 31). Over the last 11 years, the County has released its Annual Comprehensive Financial Report / Comprehensive Annual Financial Report late nine times.

An Annual Comprehensive Financial Report (ACFR), previously known as a Comprehensive Annual Financial Report (CAFR), is a collection of government financial statements that comply with the accounting requirements established by the Governmental Accounting Standards Board (GASB).

Donald McNair, Clerk & Auditor-Controller, is responsible for publishing the Annual Comprehensive Financial Report.

Fiscal Year Ended June 30, 2024 – ACRF Due 12/31/2024

Fiscal Year Ended June 30, 2023 – ACRF Due 12/31/2023 not published – Late

Fiscal Year Ended June 30, 2022 – ACFR Due 12/31/2022 not published – Late

Fiscal Year Ended June 30, 2021 – Due 12/31/2021 –Created: 4/24/23, 4:28:21 PM – Late

- Total Debt: $216,341,000.00

- Unfunded Pension Liability: $128,612,000.00

- Other Post-Employment Benefits (OPEB) Liability: $40,845,000.00

- Page 14 – https://www.tuolumnecounty.ca.gov/Archive.aspx?ADID=654

Fiscal Year Ended June 30, 2020 – Due 12/31/2020 – Created: 7/28/22, 7:38:23 AM – Late

- Total Debt: $199,982,000.00

- Unfunded Pension Liability $118,048,000.00

- Other Post-Employment Benefits (OPEB) Liability: $32,556,00.00

- Page 12 – https://www.tuolumnecounty.ca.gov/Archive.aspx?ADID=603

Fiscal Year Ended June 30, 2019 – Due 12/31/2019 – Created: 6/25/20, 2:43:35 PM – Late

- Total Debt: $188,311,000.00

- Unfunded Pension Liability: $107,835,000.00

- Other Post-Employment Benefits (OPEB) Liability: $30,655,000.00

- Page 12 – https://www.tuolumnecounty.ca.gov/Archive.aspx?ADID=602

Fiscal Year Ended June 30, 2018 – Due 12/31/2018 – Created: 10/2/19, 12:14:26 PM – Late

- Total Debt: $184,593,000.00

- Unfunded pension Liability: $103,633,000.00

- Other Post-Employment Benefits (OPEB) Liability: $30,521,000.00

- Page 12 – https://www.tuolumnecounty.ca.gov/Archive.aspx?ADID=554

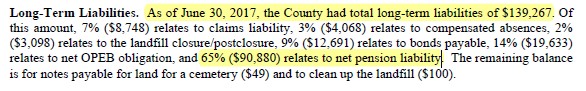

Fiscal Year Ended June 30, 2017 – Due 12/31/2017 – Created: 12/28/17, 9:52:51 AM – Late

- Total Debt $139,267,000.00

- Unfunded Pension Liability: $90,880,000.00

- Other Post-Employment Benefits (OPEB) Liability: $19,633,000.00

- Page 12 – https://www.tuolumnecounty.ca.gov/Archive.aspx?ADID=554

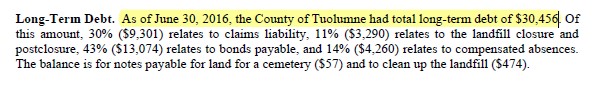

Fiscal Year Ended June 30, 2016 – Due 12/31/2016 – Created: 12/27/16, 2:59:31 PM – On time

- Total Debt: $30,456,000.00

- Unfunded Pension Liability: not reported

- Other Post-Employment Benefits (OPEB) Liability: not reported

- Page 12 – https://www.tuolumnecounty.ca.gov/Archive.aspx?ADID=477

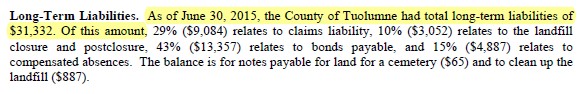

Fiscal Year Ended June 30, 2015 – Due 12/31/2015 – Created: 3/30/16, 3:03:28 PM – Late

- Total Debt: $31,332,000.00

- Unfunded Pension Liability: not reported

- Other Post-Employment Benefits (OPEB) Liability: not reported

- Page 12 – https://www.tuolumnecounty.ca.gov/Archive.aspx?ADID=434

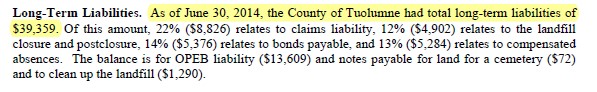

Fiscal Year Ended June 30, 2014 – Due 12/31/2014 – Created: 2/25/15, 3:21:08 PM – Late

- Total Debt: $39,359,000.00

- Unfunded Pension Liability: not reported

- Other Post-Employment Benefits (OPEB) Liability: not reported

- Page 10 – https://www.tuolumnecounty.ca.gov/Archive.aspx?ADID=334

Fiscal Year Ended June 30, 2013 – Due 12/31/2013 – Created: 12/19/13, 3:28:41 PM – On time

- Total Debt $38,364,000.00

- Unfunded Pension Liability: not reported

- Other Post-Employment Benefits (OPEB) Liability: not reported

- Page 12 – https://www.tuolumnecounty.ca.gov/Archive.aspx?ADID=259

Tuolumne County’s Financial Data

https://www.tuolumnecounty.ca.gov/154/Financial-Data

2022-07-17 CPRA request – Tuolumne County’s CARF 2020 2021 2022

2023-03-19 CPRA request – Tuolumne County’s CARF 2021

2023-04-18 CPRA request – Tuolumne County CAFR extension 2021 2022

2023-04-19 CPRA response – Tuolumne County CAFR extension 2020 2021

- County of Tuolumne Financial Data

- Most Recent Comprehensive Annual Financial Report – 2021

- View All Comprehensive Annual Financial Reports – 2006 to 2021

Annual Comprehensive Financial Report:

ACFR stands for Annual Comprehensive Financial Report. An ACFR is a set of financial statements for a state, municipality, or other governmental entity that comply with the accounting requirements established by the Governmental Accounting Standards Board (GASB). It must be audited by an independent auditor using generally accepted government auditing standards.

The ACFR consists of three sections: Introductory, Financial, and Statistical. An ACFR contains the actual results of the prior year’s financial activities.

OPEB (Other Post-Employment Benefits):

Retiree medical

Regular financial report/budget:

A regular annual report/budget typically presents only basic financial statements about the government. An ACFR presents a broader variety of important information intended to help the stakeholders understand the financial health of the governmental entity.

A budget is a plan for a future fiscal period, typically a year, primarily showing how tax revenue will be allocated.